The 1st of January is an important date for many people around the world, but if you’ve been thinking of installing solar panels, it’s less of a celebration and more of a disappointment. Why? Because the solar rebates offered by the Australian government decrease on this date every year.

What is the STC rebate?

If you’ve been looking into installing solar panels, you might be familiar with the STC rebate, but, like anything related to government policy, it can be pretty complex. The general gist of this government grant for solar panels in Australia is to encourage homeowners and businesses to install solar systems by offering financial incentives.

This particular incentive, known as the Small-Scale Renewable Energy Scheme (or SRES), was introduced in 2011 by the Australian Federal Government. Under this scheme, whenever you buy solar, you’ll be awarded a certain number of Small-scale Technology Certificates (or STCs). These STCs can then be passed on to your solar installer in exchange for a discount.

The number of STCs you’ll be given depends on a few things, including the size of the system you’re purchasing and the area where you live. Similar to investment stocks, the value of an STC changes according to the market.

Why are the STC rebates decreasing?

The STC rebates are decreasing because the entire STC rebate programme is being phased out and will end in 2030. To do this, the government is slowly reducing the number of STCs available for people who install solar systems.

That’s why each year on the 1st of January, the number of STCs that you’re entitled to receive decreases.

For example, if someone in Brisbane purchased and installed a 6.6kW solar power system in 2022, they would have received 82 STCs (a discount of about $3,116*). If the same person waited until 2023 to purchase, they would only receive 72 STCs (a discount of about $2,736*).

Every year you wait to have a solar system installed is another year you miss out on more STCs and a bigger discount.

*Based on an average STC price of $38.

What kind of discount can I receive?

As we mentioned, the amount of STCs you can receive, and therefore how much money you can save, depends on a few different factors. These include the size of your solar panel system, the zone you live in, the value of STCs at the time of installation, and the year that you have your system installed.

1. The size of your solar panel system

The number of STCs you can receive is based on how much ‘green’ electricity your system will produce. For example, the bigger your solar panel system, the bigger the amount of electricity produced and the more STCs you’ll receive.

2. The STC zone you live in

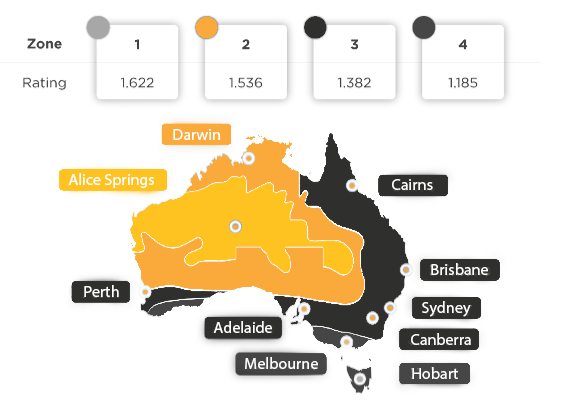

Australia has been separated into four different zones according to how much solar energy each area can generate. Every zone has its own rating—for example, Alice Springs (Zone 1) can generate more solar energy than Sydney (Zone 3) due to higher amounts of sunlight, so it has a higher rating of 1.622. The higher the rating of your zone, the more STCs you’re eligible to receive.

To make it easier for you, take a look at the Zone Map below.

3. The value of an STC at the time of installation

As the number of STCs you can receive each year steadily decreases, the dollar value of each individual STC also fluctuates. For example, in October 2020, STCs were trading at $37.80 each, whereas in 2023, the average STC price was around $40. When doing your calculations, using an average of $38 per STC is probably about right.

4. The year that you have your solar panels installed

The longer you wait to install your solar panel system in Australia, the lower the discount you’ll receive. That’s because, as you now know, the number of STCs you’re entitled to decreases at the start of each year.

As well as a decrease in STCs, the deeming period (the period in which renewable energy is created up until 2030, when the scheme ends) will also decrease by one year. For systems installed in 2022, the deeming period is a maximum of 9 years, and for systems installed in 2024, the deeming period is a maximum of 7 years.

If this all sounds a bit confusing, visit the Australian Government’s Clean Energy Regulator website for more information.

A helpful example

Jack is looking to get a 6.6kW solar panel system installed on his Brisbane home (Zone 3) in 2024. He wants to know how many STCs he’ll be eligible to receive and how much money he’ll save. To work this out, he’ll need this calculation:

Solar Power System Size (kW) x Zone Rating x Deeming Period = Number of STCs

So the numbers would look something like:

6.6 x 1.382 x 7 = 63 STCs (rounded down)

To calculate his overall discount, Jack needs to multiply his STCs by the current market value. We can use $38 in this example. So:

63 x 38 = $2,394 discount

You can also use our STC Rebate Calculator to find out how much you can save.

Ready to install?

Now that you know a bit more about the STC rebate and how important it is to get started ASAP to make the most of this incentive, you might be taking a closer look at your options for solar panels in Australia.

A great option is Think Renewable! We make it our mission to stand out in a competitive and confusing market through our excellent customer service and top-notch after sale care.

As a proudly 100% Australian-owned and operated business with local customer service support and offices in WA, NSW, and QLD, we pride ourselves on making solar simple, affordable, and sustainable.

Our trusted installers are fully licensed CEC-accredited electricians, so you can rest assured that you’ll be eligible to receive the STC rebate and that the job will be done to the highest possible standard.

Contact us today to get the ball rolling and claim your solar power discount in 2024.